Hedging Inflation with Direct Lending

Thesis

The current macro backdrop should have investors questioning how they can preserve purchasing power in an environment of rapidly rising prices.

“Direct lending” offers the opportunity to do so over time, with high quality paper located in the senior tranches of the corporate capital stack.

Our approach in the “Direct Lending” asset class provides investors with:

Significant yield premium compared to public markets.

Floating rate structure, poised to participate in a rising interest rate environment.

High-quality, senior loans secured by cash flows, with a first lien priority in the event of default.

Macro backdrop…

2022 has gotten off to a tough start. The macro dynamics coming into the year were enough to create concern for any investor. High valuations, peaking profit margins, low bond yields and “transitory” inflation were just a few headwinds that come to mind. Fast forward to middle of March, and the focus has shifted, with the backdrop becoming more dire. Investors must now contend with the inflationary implications of sanctions and war, what affect they will have on global GDP growth, and whether their investments will be able to preserve purchasing power in the face of a record rise in prices.

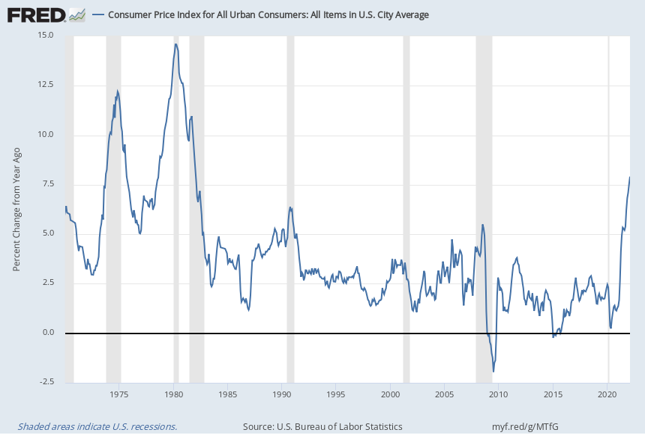

Although we were supposed to be on the backside of “transitory” at this point, February CPI rose at the fastest pace in nearly 4 decades from a year prior (chart below). With investors everywhere concerned about inflation eating away at their portfolios, public asset classes offer few solutions…

What is “Direct Lending”?

“Direct Lending” is exactly as it sounds, strategies in the space lend money directly to small and medium businesses who cannot access financing through a traditional bank. The asset class grew substantially in the wake of the 2008 financial crisis, as millions of creditworthy businesses were left without a reliable lender when banking regulations tightened.

Direct Lending offers a variety of flavors, but in broad terms, it provides investors with higher yields (chart below) and access to higher quality loans, in return for accepting various levels of illiquidity. Loans in the space often exhibit stronger covenants, lower default rates, and higher recovery rates when compared to public market comparables [1].

Our Approach

For clients of ours, we have used direct lending to the hedge the risk of a highly inflationary environment. Although it is not the only hedge, it is a very strong option given the yield premium offers a hedge to rising prices, and the quality of the underwriting should serve to preserve the principal.

The strategy we use in this space is run by a group that has been lending money to small businesses since the late 90’s. They made a name for themselves, as well as the quality of their underwriting, during the tech wreck and the 2008 financial crisis, remaining open for business while competitors faltered. In 2021 their 12th vintage yielded 15% in current income for investors (vs. 3.7% for High Yield Bonds [2]), was diversified across more than 500 loans, and 50 different industries. As of the end of Q3 2021, the strategy was running at a net IRR of 13.7% [3].

Outside of the strength of their recent performance, below are four hallmarks of the strategy which makes it attractive in this environment:

Significant Yield Premium: Historically speaking, substantial yield premium compared to public markets (refer to above chart).

Floating Rate: 100% Floating Rate loans, which automatically adjust as interest rates rise.

Strong Underwriting: Defaults across the loan book have been less than 1% since the strategy’s inception, less than half of the comparable public index [4].

Senior-secured, first lien: Over 95% of the loans are senior in the capital stack, secured by cash flows of the underlying business, and first in line to be paid back in the event of a default.

A high-quality portfolio of loans generating a significant yield premium to the public market may not be the only option to hedge against inflation, but it is certainly one worth considering…

Sources:

[1] “Direct Lending: An Opportunity Within Private Debt” – Aon, March 2018

[2] Morningstar, as of 12.31.2021. Referenced security “HYG”

[3] Data through the end of September, more information available upon request.

[4] Public market comparable is S&P/LSTA Leveraged Loan Index.

Disclosures:

All information has been obtained from sources believed to be reliable, but its accuracy is not guaranteed. The information contained above is for illustrative purposes only. The views expressed in this commentary are subject to change based on market and other conditions. These documents may contain certain statements that may be deemed forward-looking statements. Please note that any such statements are not guarantees of any future performance and actual results or developments may differ materially from those projected. Any projections, market outlooks, or estimates are based upon certain assumptions and should not be construed as indicative of actual events that will occur.

Please note that nothing in this content should be construed as an offer to sell or the solicitation of an offer to purchase an interest in any security or separate account. Nothing is intended to be, and you should not consider anything to be direct investment, accounting, tax or legal advice to any one investor. Consult with an accountant or attorney regarding individual accounting, tax or legal advice. No advice may be rendered unless a client service agreement is in place.

No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. All investments include a risk of loss that clients should be prepared to bear. Different types of investments involve varying degrees of risk and there can be no assurance that any specific investment will either be suitable or profitable for a client’s investment portfolio. Economic factors, market conditions and investment strategies will affect the performance of any portfolio, and there are no assurances that it will match or outperform any benchmark. Asset Allocation may be used in an effort to manage risk and enhance returns. It does not, however, guarantee a profit or protect against loss.

New World Advisors, LLC ("New World") is a Registered Investment Advisor ("RIA") with the U.S. Securities and Exchange Commission (“SEC”). New World provides investment advisory and related services to clients nationally. New World will maintain all applicable notice filings, registrations and licenses as required by the SEC and various state regulators in which New World conducts business. New World renders individualized responses to persons in a particular state only after complying with all regulatory requirements or pursuant to an applicable state exemption or exclusion.